A Crash Course on the soon-to-be new big, beautiful law

Here's the Deal - Experts warn we'll feel the impacts of this legislation for decades to come

I promise not every post will be about one piece of legislation. But what can I say, I launched this newsletter right as Congress fast-tracked the passage of the “big, beautiful bill.”

So, let’s unpack the massive bill.

Here’s the rundown:

The House passed the final version of the bill, 218-214. Every Democrat, along with two Republicans, voted against it, and the rest of the GOP rallied behind it.

The legislation is a combination of tax breaks, spending cuts, and new money for Republican priorities.

President Trump is planning to sign the “One Big Beautiful Act” into law at the White House later today. This was the President yesterday touting the victory in Iowa.

Here’s the breakdown:

“Be careful what you wish for, especially on a piece of legislation that's going to have downstream effects for years.” - Casey Burgat

Shortly after the House vote Thursday afternoon, I interviewed George Washington University political science professor Casey Burgat about the real-world implications of this legislation. He also has a Substack called

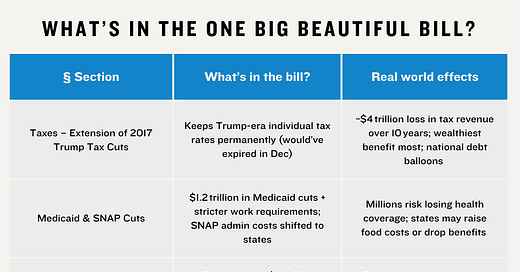

.Burgat shared this graphic with me, breaking down the major sections of the bill and how the legislation would affect people across the country.

The “One Big Beautiful Bill Act” contains $4.5 trillion in tax breaks. This includes some of President Trump’s campaign promises, like temporary tax breaks on tips, overtime, and auto loans. It also provides some tax credits for seniors and families with children and makes the 2017 tax cuts approved during Trump’s first term permanent.

“This is going to lean into a lot of people's worst instincts about politics, is that these, the bulk of these benefits, are going to go to the wealthiest amongst us, right? They're going to go to the rich, they're going to go to the powerful. They're going to go to corporations,” said Burgat.

There’s also $350 billion in the legislation for President Trump’s defense and national security priorities, including money for a U.S.-Mexico border wall and hiring thousands of new Immigration and Customs Enforcement officers.

So, how do you pay for all this? That’s where the cuts to Medicaid and SNAP come in. The bill would cut more than a trillion dollars from these federal social safety net services. Burgat said these cuts will be detrimental to households that rely on these assistance programs every month for food and health coverage.

“No one knows what billions of dollars means. We see it, we can try to internalize it, but that's not a tangible thing,” said Burgat. “When we see it in our neighbors, when we see it in our students, when we see it, see it in our friends, that's when it's going to start to be real.”

Here’s what happens next:

Both political parties will be talking about this “One Big Beautiful Bill Act” for a while, but keep a close eye on the messaging.

Democrats are already vowing to make this legislation a key part of their 2026 midterm strategy. House Leader Hakeem Jeffries hit that point home during his record floor speech Thursday.

Republicans are claiming victory right now, but Burgat believes that could change as Americans start to feel the effects of the legislation over time.

“When those start hitting everyday families, when they start hitting people's pocketbooks, when it starts affecting the economy at large, that's when we're going to have a different conversation, where those cheers all of a sudden might translate into distancing themselves from supporting that big, beautiful bill right now,” said Burgat.

For more political deep dives and civic lessons, make sure you check out

.